Unlocking the Secrets to a Longer Life

Discover simple yet effective tips to enhance your longevity and well-being.

Marketplace Liquidity Models: The Secret Sauce to Thriving in the Digital Economy

Unlock the secret to success in the digital economy! Discover how marketplace liquidity models can fuel your growth and profits.

Understanding Marketplace Liquidity: Key Models Explained

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without affecting the asset's price. Understanding the different models of liquidity is essential for investors and market participants to make informed decisions. Two primary models help conceptualize liquidity: the order book model and the market maker model. In the order book model, buy and sell orders are listed, providing transparency about how many assets are available at various price points. Conversely, the market maker model relies on designated entities or individuals that commit to buying and selling assets at specified prices, often facilitating smoother transactions, especially in less liquid markets.

Another crucial aspect of marketplace liquidity involves the concept of spread, which is the difference between the bid and ask prices. A tighter spread typically indicates a highly liquid market, where buyers and sellers can transact at prices close to what is fair market value. Understanding these key liquidity models not only aids in recognizing market efficiency but can also help optimize trading strategies. By assessing factors such as trading volume and order depth, investors can better navigate the complexities of market dynamics and mitigate risks associated with low liquidity.

Counter-Strike is a highly popular tactical first-person shooter game known for its competitive gameplay and team-based mechanics. Players can enhance their experience through various in-game items, and they can find effective deals by using the daddyskins promo code for skins and upgrades. The game has evolved over the years, leading to numerous iterations and a thriving esports scene.

How to Optimize Liquidity in Your Digital Marketplace

Optimizing liquidity in your digital marketplace is essential for ensuring smooth transactions and maintaining user engagement. Liquidity refers to how easily assets can be bought or sold without affecting their price. To achieve optimal liquidity, marketplace owners should focus on increasing the volume of transactions. Strategies include implementing an intuitive user interface, providing robust search capabilities, and offering competitive pricing. Additionally, leveraging liquidity pools can help match buyers and sellers more effectively, increasing overall marketplace activity.

Another important aspect of optimizing liquidity is fostering a vibrant community of buyers and sellers. This can be achieved by utilizing social media platforms and online forums to promote the marketplace and engage users. Regularly updating product listings and ensuring accurate descriptions helps in building trust, which is vital for attracting repeat customers. Furthermore, consider incentivizing early adopters with rewards or exclusive deals to enhance experience and encourage participation, ultimately leading to increased liquidity within your digital marketplace.

What Makes a Marketplace Thrive? Insights into Liquidity Models

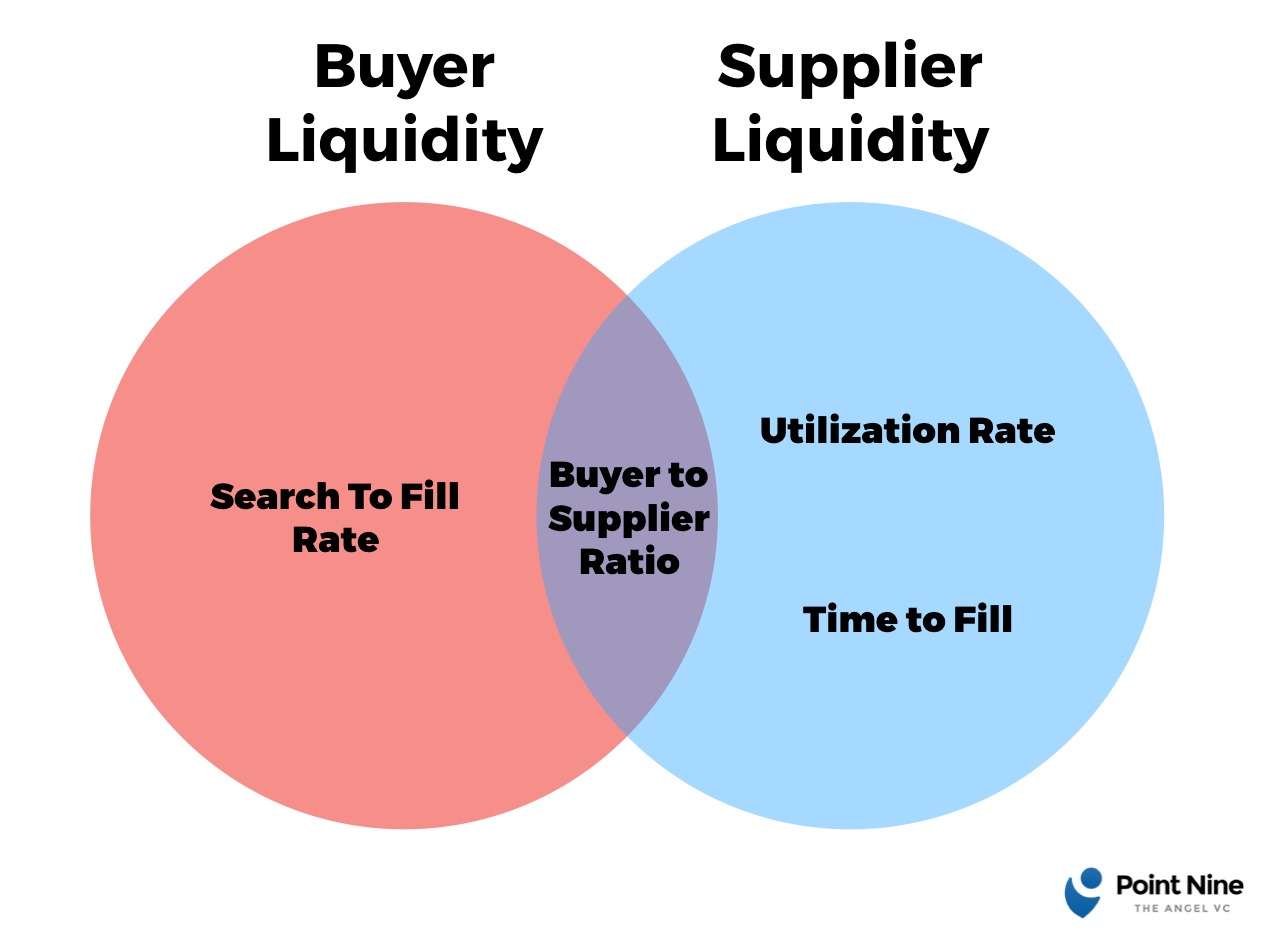

A thriving marketplace is often a well-oiled machine that balances the supply of goods and services with consumer demand. At the heart of this balance lies the concept of liquidity models, which essentially refers to how easily transactions occur within the platform. For a marketplace to thrive, it must ensure that buyers can quickly find what they are looking for, while sellers can efficiently reach their target audience. This is largely facilitated by the integration of sophisticated algorithms and user-friendly interfaces that enhance user experience and foster engagement.

Moreover, there are several key factors that contribute to marketplace liquidity, including network effects, where the value of the marketplace increases as more participants join, and effective marketing strategies that attract both buyers and sellers. In addition, implementing a feedback loop through ratings and reviews can help maintain quality and trust within the community. As such, a successful marketplace must continuously evolve its liquidity model to adapt to changing market conditions and ensure long-term sustainability.