Unlocking the Secrets to a Longer Life

Discover simple yet effective tips to enhance your longevity and well-being.

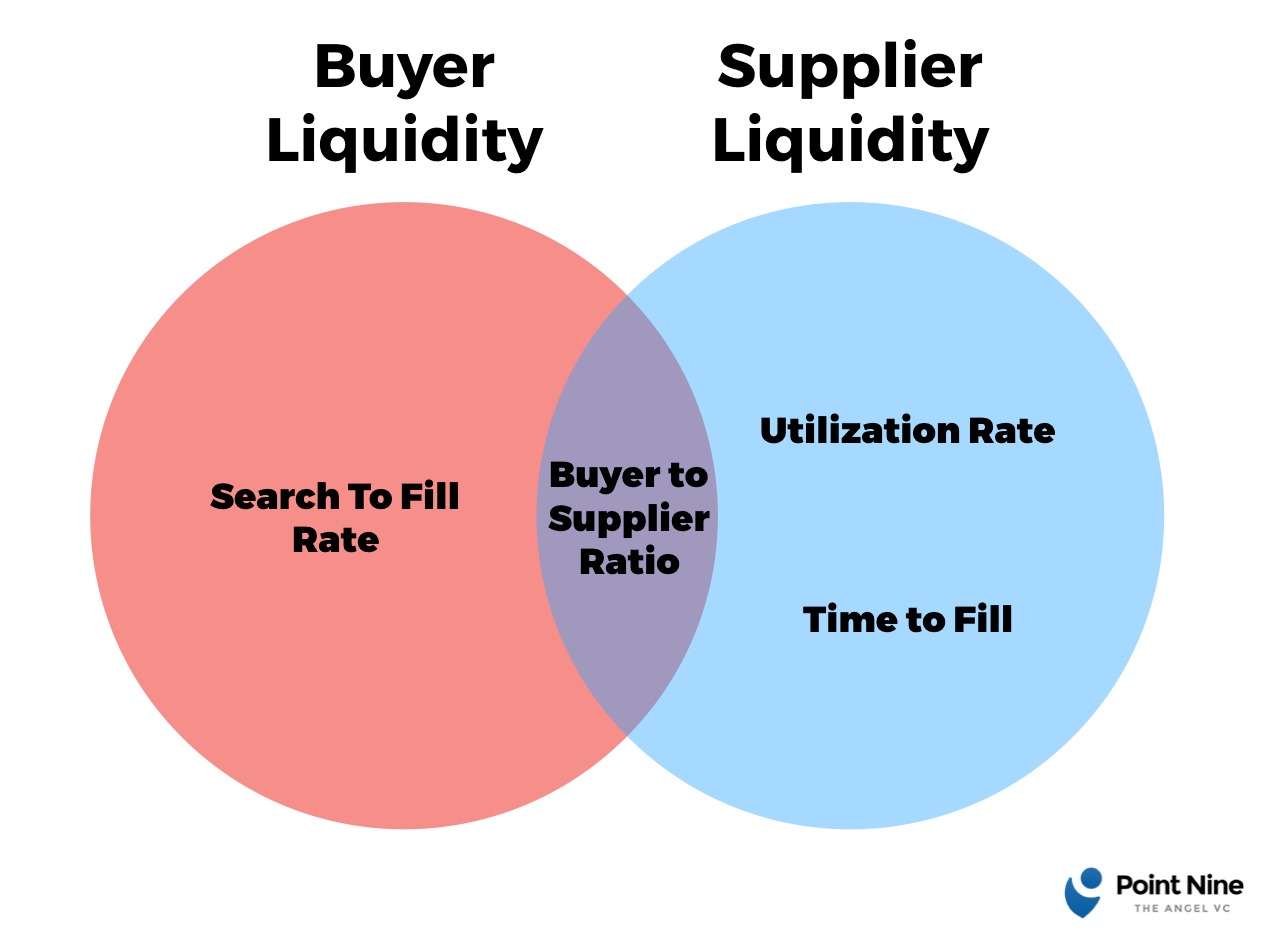

Marketplace Liquidity Models: A Balancing Act Between Buyers and Sellers

Discover the secrets of marketplace liquidity models and how they expertly balance buyer and seller dynamics for maximum profit.

Understanding Marketplace Liquidity: How Buyers and Sellers Find Balance

Understanding marketplace liquidity is crucial for both buyers and sellers looking to navigate the complexities of any trading environment. Liquidity refers to how easily assets can be bought or sold in a marketplace without causing a significant impact on their price. In a liquid market, transactions occur with minimal friction, allowing participants to enter and exit positions quickly. This balance between supply and demand is fundamental as it determines the efficiency of a marketplace and impacts everything from pricing to trading volume.

For buyers and sellers, finding this balance is key to maximizing their returns and minimizing risk. When liquidity is high, sellers can confidently list their assets knowing that buyers are eager to purchase. Conversely, buyers can find the assets they want without facing exorbitant prices or lengthy delays. To achieve this equilibrium, it is essential for market participants to understand various factors that influence liquidity, such as trading volume, market trends, and economic conditions. Ultimately, navigating these elements can lead to a more effective trading strategy.

Counter-Strike is a highly popular multiplayer first-person shooter that has captured the attention of gamers worldwide. Players compete in teams, taking on various roles as terrorists or counter-terrorists. For those looking to enhance their gaming experience, consider using a daddyskins promo code to access exclusive in-game items and skins.

The Role of Market Structure in Enhancing Liquidity for Buyers and Sellers

Understanding market structure is crucial for enhancing liquidity in any trading environment. Market structure refers to the organization and characteristics of a market, which fundamentally influence how buyers and sellers interact. For instance, in a market characterized by a high degree of competition, liquidity tends to be greater, as numerous buyers and sellers are actively participating. This increased participation allows for quicker transactions and narrower bid-ask spreads, ultimately benefiting all market participants.

Furthermore, the different types of market structures—such as perfect competition, monopolistic competition, oligopoly, and monopoly—play specific roles in determining liquidity levels. In a perfectly competitive market, for instance, the large number of buyers and sellers ensures that prices remain stable and transactions can occur with ease. Conversely, in markets dominated by a few players, liquidity can suffer, leading to wider spreads and potential difficulties for both buyers and sellers trying to execute trades efficiently. Therefore, understanding the implications of market structure is essential for anyone looking to navigate the complexities of liquid and illiquid markets effectively.

What Factors Influence Marketplace Liquidity and How Can You Optimize It?

Marketplace liquidity is influenced by several key factors that determine how easily assets can be bought or sold without causing drastic changes in their prices. The number of buyers and sellers in the marketplace is critical; a larger pool typically enhances liquidity as it fosters competition and enables quick transactions. Additionally, trading volume — the total activity level within the marketplace — plays a significant role. Higher trading volumes often correlate with increased liquidity, allowing investors to enter and exit positions seamlessly. Other factors include market structure, which encompasses the rules, regulations, and accessibility of the marketplace, and order types, which can facilitate smoother transactions.

To optimize marketplace liquidity, stakeholders can implement various strategies. First, enhancing order matching algorithms can significantly improve transaction speed and efficiency, thereby minimizing the potential for slippage. Second, fostering a larger user base through targeted marketing efforts can increase both buying and selling activity, thus creating a more vibrant market. Offering incentives, such as reduced transaction fees for high-volume traders or liquidity providers, can also encourage participation. Lastly, maintaining transparent communication about market conditions and updates can build trust and encourage more users to engage actively, ultimately enhancing overall liquidity.