Unlocking the Secrets to a Longer Life

Discover simple yet effective tips to enhance your longevity and well-being.

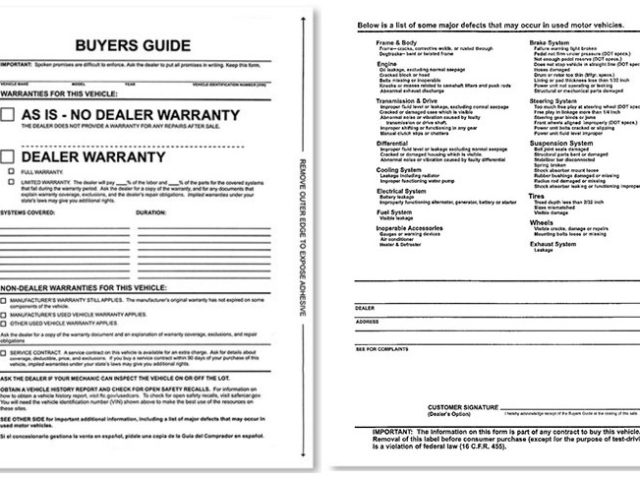

Wheels of Fortune: Your Car Buying Adventure

Unleash your car buying journey! Discover tips, tricks, and secrets to score the best deals on wheels in Wheels of Fortune.

5 Essential Tips for Negotiating Your Car Price

Negotiating the price of a car can be daunting, but with the right strategies, you can secure a better deal. Research is your best friend when it comes to understanding the market value of the car you're interested in. Make sure to check various resources for the car's fair market price, including online valuation tools and local dealership prices. Once you have this information, you can confidently present a counter-offer that is reasonable and backed by your findings.

Another essential tip is to stay calm and confident during the negotiation process. Car salespeople are trained negotiators who may use persuasive tactics to convince you to pay more. Stay focused on your budget and goals while remembering that the dealer wants to make a sale. By maintaining your composure and sticking to your researched price, you increase your chances of getting a favorable outcome. Remember, it's important to know when to walk away if your price isn't met; sometimes, that can be the most effective strategy of all.

Understanding the Different Types of Car Financing Options

When it comes to purchasing a vehicle, understanding the different types of car financing options available is crucial for making an informed decision. The most common options include traditional bank loans, credit union financing, and dealer financing. Traditional bank loans typically offer competitive interest rates, especially for buyers with excellent credit. Credit unions often provide personalized services and lower rates but might require membership. Dealer financing, on the other hand, can simplify the buying process but may involve higher interest rates and fees.

Additionally, buyers should consider other alternatives like lease agreements and pay-per-mile financing. Leasing allows drivers to enjoy a new car every few years but often comes with mileage limits and excess wear charges. Pay-per-mile financing is an innovative option that charges owners based on the miles driven, potentially saving money for those who drive less. Understanding the pros and cons of each car financing option can help you choose the best path for your financial situation and driving needs.

What to Look for During a Test Drive: A Comprehensive Guide

When embarking on a test drive, it's essential to focus on several key factors to ensure that the vehicle meets your needs and expectations. First, examine the comfort level of the car by adjusting the seat, steering wheel, and mirrors to see how well you can achieve an optimal driving position. Pay attention to visibility from the driver's seat, including blind spots and the effectiveness of mirrors. Also, make sure to assess interior features such as infotainment systems, air conditioning, and the overall layout of controls to gauge user-friendliness.

Next, it’s vital to consider the driving experience itself. Evaluate how the car performs in different conditions, such as acceleration, braking, and handling during turns. Listen for any unusual noises, which could indicate underlying issues. Additionally, test how the vehicle reacts on various terrains, such as highways or city streets, to determine its suitability for your lifestyle. Lastly, don't hesitate to ask the salesperson about warranty options and service details, ensuring you understand what support you will have after your purchase.