Unlocking the Secrets to a Longer Life

Discover simple yet effective tips to enhance your longevity and well-being.

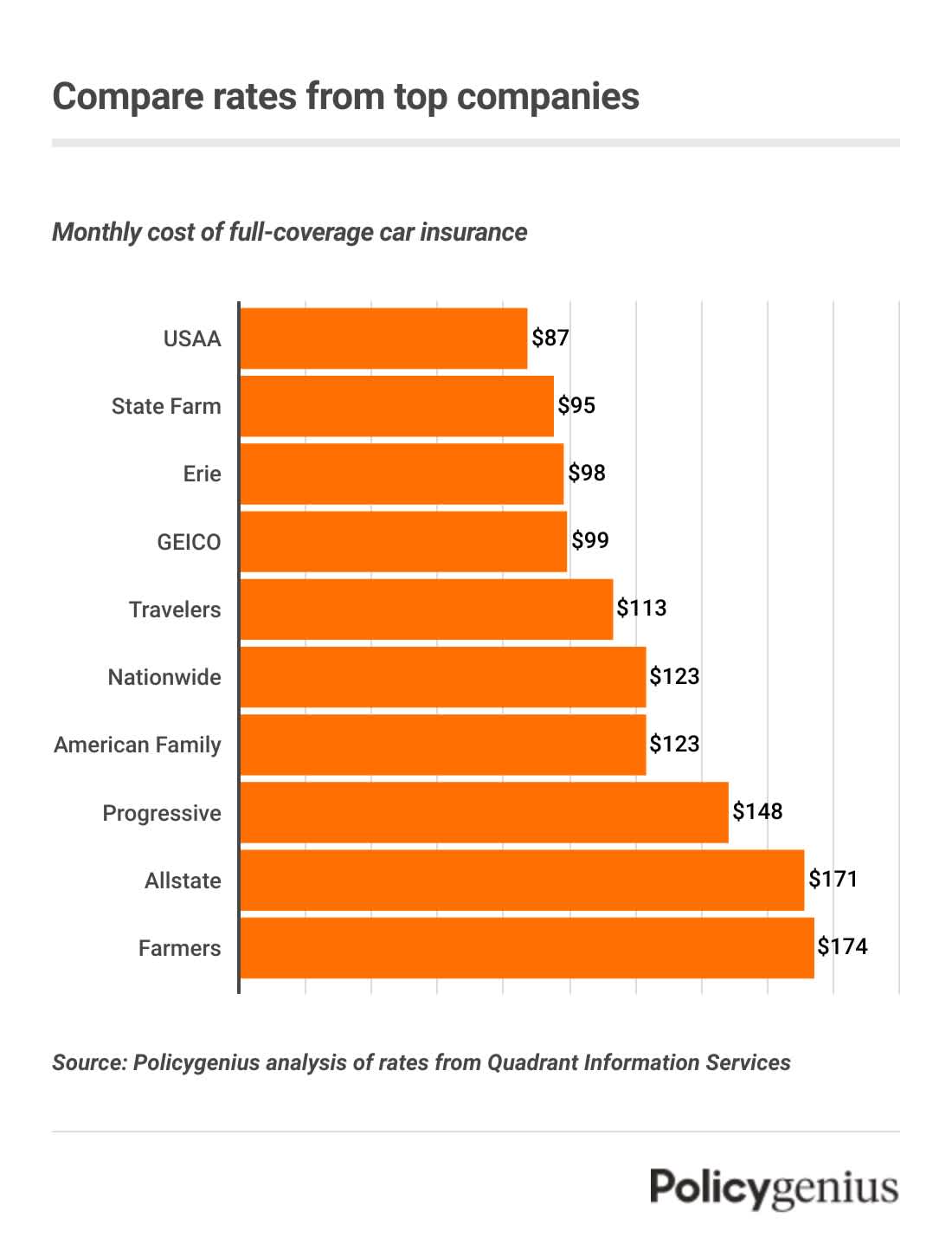

Insurance Showdown: Who Will Save You More?

Discover which insurance provider offers the biggest savings! Uncover secrets to maximizing your coverage and minimizing costs today!

Top 5 Factors That Determine Your Insurance Rates

Understanding the top factors that determine your insurance rates is crucial for managing your policy costs effectively. One of the primary factors is your credit score. Insurance companies often use credit scores as a way to assess risk, meaning that a higher score could potentially lower your premiums. According to a report by the National Association of Insurance Commissioners, insurers may view individuals with poor credit as more likely to file claims, thus increasing their rates.

Another significant factor is your driving record, particularly for auto insurance. If you have multiple traffic violations or accidents, insurers may categorize you as a high-risk driver, leading to higher premiums. Additionally, location plays a crucial role; for instance, living in an area prone to natural disasters can impact home insurance rates significantly. To learn more about how these factors influence costs, check out this insightful guide from The Balance.

Exploring the Pros and Cons of Different Insurance Providers

When exploring the pros and cons of different insurance providers, it's essential to consider various factors that can impact your decision-making process. Insurance providers vary significantly in the coverage they offer, customer service quality, and pricing structures. For example, some companies may provide comprehensive policies that cover a wide range of circumstances, while others may focus on low-cost plans that could leave gaps in coverage. Understanding these differences can help you identify which provider aligns best with your personal needs. Researching consumer reviews can offer valuable insight into the reliability and transparency of each company.

Additionally, evaluating the claims process is a crucial aspect when exploring the pros and cons of different insurance providers. The ease of filing a claim and the speed at which it is processed can make a significant difference during stressful times. Some insurance providers are known for their efficient claims handling according to studies, while others may have a reputation for delays or complications. It's also wise to consider the financial stability of the company, as this can influence their ability to pay out claims when needed. Always check the AM Best ratings to gauge the financial strength of potential providers.

How to Choose the Best Insurance Policy for Your Needs

Choosing the best insurance policy for your needs requires careful consideration of several factors. Start by assessing your current situation, including your financial stability, assets, and specific risks you want to cover. Make a list of your must-haves, comparing consumer reports to determine which types of coverage are most relevant to you. Additionally, consider your budget, as policies can vary significantly in price depending on the coverage and provider. Once you have a clear understanding of your requirements, gather quotes from multiple insurers to find competitive rates.

Next, it's crucial to read the fine print of each policy before making a decision. Look for coverage limits, exclusions, and any available discounts. It might be helpful to consult online reviews and recommendations from trusted sources such as NerdWallet to gauge other customers' experiences with different providers. Lastly, don't hesitate to ask questions and seek clarification from insurance agents to ensure you fully understand the terms. By taking these steps, you can select a policy that not only meets your needs but also provides peace of mind.