Unlocking the Secrets to a Longer Life

Discover simple yet effective tips to enhance your longevity and well-being.

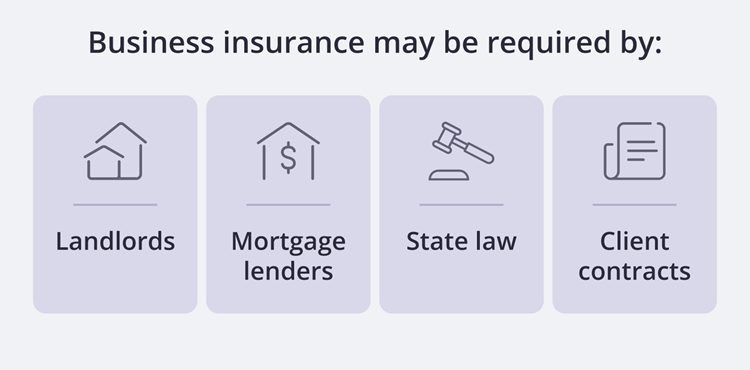

Bail Out Your Business: Why Insurance is Your Best Life Vest

Protect your business from the storms of life! Discover why insurance is the ultimate safety net for entrepreneurs. Dive in now!

Top 5 Insurance Policies Every Business Should Consider

Every business, regardless of its size or industry, should consider investing in the right insurance policies to safeguard against unforeseen challenges. General Liability Insurance is essential as it protects businesses from various claims related to bodily injury, property damage, and advertising injuries. This policy not only safeguards your assets but also enhances your credibility in the marketplace. Additionally, businesses should look into Property Insurance, which covers damage to physical assets such as buildings and equipment. According to The Balance, this coverage is crucial for mitigating financial risks linked to damage from fire, theft, or natural disasters.

Another vital policy is Workers' Compensation Insurance, which is mandated in most states and offers financial assistance to employees injured on the job. It covers medical expenses and lost wages, providing peace of mind for both employers and employees. Furthermore, businesses should consider Professional Liability Insurance—commonly known as errors and omissions insurance—especially in service-based industries. This policy protects against claims of negligence and can be a critical safeguard for professionals. Lastly, Breach of Data Insurance is increasingly important in today's digital age, protecting against financial losses stemming from data breaches. For more detailed insights on these policies, refer to Nolo.

How Business Insurance Can Save You in Times of Crisis

Business insurance plays a crucial role during unexpected challenges, acting as a financial safety net when your operations are disrupted. Having the right coverage can help mitigate loss and maintain business continuity. For instance, SBA guidelines suggest that businesses with adequate insurance are better equipped to navigate crises such as natural disasters, economic downturns, or health emergencies. With policies such as business interruption insurance, companies can receive compensation for lost income, allowing them to keep their employees on payroll and cover fixed expenses while they recover.

Moreover, having business insurance fosters trust with clients and stakeholders, showcasing a commitment to risk management and preparedness. Businesses that are properly insured can assure their clients that they will uphold their obligations even amidst adversity. This can help maintain customer loyalty and protect your brand reputation. According to a study by the IBISWorld, businesses that invest in comprehensive insurance coverage tend to recover more quickly from setbacks, ultimately continuing to thrive in the long term.

Is Your Business Prepared for the Unexpected? The Role of Insurance

In today's unpredictable business environment, being prepared for the unexpected is more crucial than ever. Natural disasters, economic downturns, and unforeseen liabilities can strike at any moment, potentially crippling even the most robust enterprises. Therefore, it is essential for businesses to have comprehensive insurance coverage in place. This not only protects physical assets but also safeguards against revenue loss and legal liabilities that may arise unexpectedly.

Moreover, implementing a solid risk management strategy that includes insurance can provide peace of mind and financial stability. Policies such as general liability, property, and business interruption insurance can serve as a safety net, ensuring that your business can recover swiftly from unforeseen events. According to the Small Business Administration, understanding your insurance options and regularly reviewing your coverage is vital for maintaining resilience in the face of challenges. By prioritizing insurance, you're not just protecting your assets; you are paving the way for sustainable growth in the long run.